Pharma Market Access in Israel.

your product. our efforts.

Israeli Health Care System

In June 1994, the Israeli parliament passed the National Health Insurance Law (NHIL), a turning point in the history of the Israeli healthcare system.

With this, the system underwent an overhaul, with the goal of ensuring the sustainability of the Israeli healthcare system while adhering to the declared principles of “justice, equality and mutual assistance”.

For the first time, a mandatory, government-funded, National Health Basket (NHB) was defined, to be provided by the four existing health insurance organizations, known as Sick Funds (HMOs), while certain services remained under direct responsibility of the Ministry of Health (MoH). Furthermore, an obligatory health tax was created, earmarked to fund these health services, thus ensuring the system’s sustainability.

Government funding for the HMOs was allocated based on pre-determined criteria that consider the number of members in each fund, as well as their demographic characteristics. These, along with other reforms included in the law, brought about the single greatest change in the history of the Israeli healthcare system.

Israel’s public healthcare system is well-advanced by international standards.

Israel spends ~7.5% of its GDP on healthcare, providing universal coverage to the entire population via 4 independent health management organizations (HMOs) and a network of hospitals, community clinics and specialized doctors. Israeli healthcare facilities are modern and are open to adopt new, costeffective technologies and procedures.

The 4 HMOs are key players with the reimbursement system as the yearly health reimbursement budget is allocated to the HMOs by the government.

Medical insurance is compulsory to all citizens and medical care if offered free of charge to all insured.

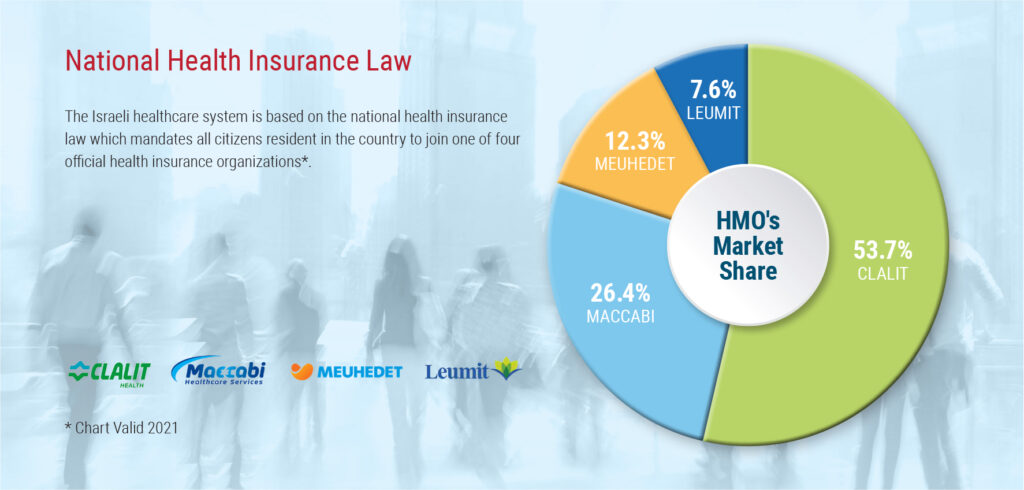

The HMOs market share is not equal, with Clalit being the largest one, followed by Maccabi, Meuhedet and Leumit.

Overview

In June 1994, the Israeli parliament passed the National Health Insurance Law (NHIL), a turning point in the history of the Israeli healthcare system.

With this, the system underwent an overhaul, with the goal of ensuring the sustainability of the Israeli healthcare system while adhering to the declared principles of “justice, equality and mutual assistance”.

For the first time, a mandatory, government-funded, National Health Basket (NHB) was defined, to be provided by the four existing health insurance organizations, known as Sick Funds (HMOs), while certain services remained under direct responsibility of the Ministry of Health (MoH). Furthermore, an obligatory health tax was created, earmarked to fund these health services, thus ensuring the system’s sustainability.

Government funding for the HMOs was allocated based on pre-determined criteria that consider the number of members in each fund, as well as their demographic characteristics. These, along with other reforms included in the law, brought about the single greatest change in the history of the Israeli healthcare system.

Israel’s public healthcare system is well-advanced by international standards.

Israel spends ~7.5% of its GDP on healthcare, providing universal coverage to the entire population via 4 independent health management organizations (HMOs) and a network of hospitals, community clinics and specialized doctors. Israeli healthcare facilities are modern and are open to adopt new, costeffective technologies and procedures.

The 4 HMOs are key players with the reimbursement system as the yearly health reimbursement budget is allocated to the HMOs by the government.

Medical insurance is compulsory to all citizens and medical care if offered free of charge to all insured.

The HMOs market share is not equal, with Clalit being the largest one, followed by Maccabi, Meuhedet and Leumit.

National Health Insurance Law

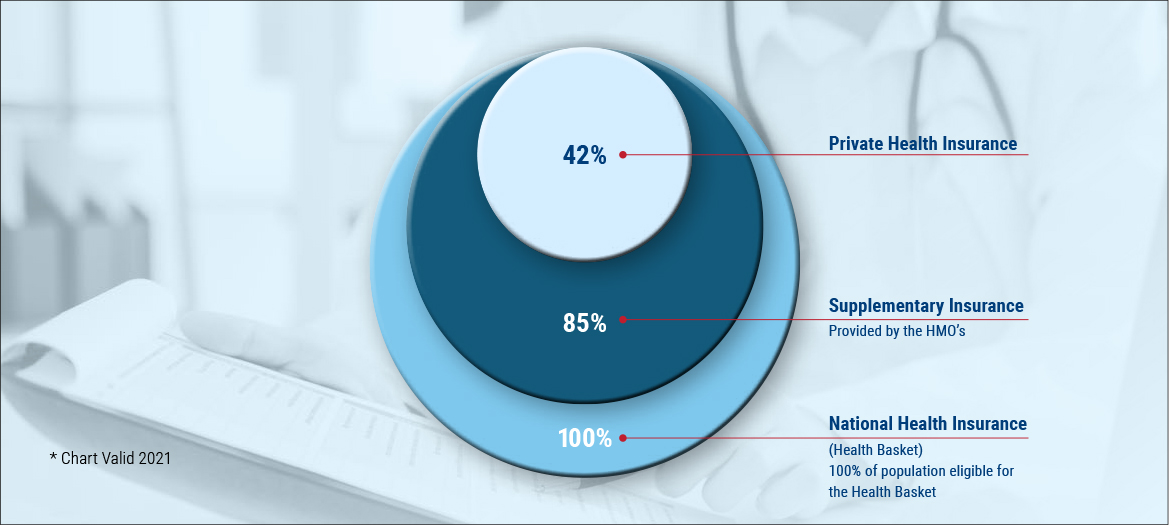

This is another route for marketed HTAs. Aprox. 85% of population chose to add this layer of insurance. As for private medical insurance, 42% of population add this option but one should note that from the marketing aspect – this option is almost nil. Israel’s healthcare technology market is estimated at $6.2 billion, of which devices account for $2.4 billion and pharma $3.8 billion.

Imports make up over 65% of the device market and about 60% of the pharma market. Top medical device imports are surgical instruments and other medical electronics, lab reagents, diagnostic equipment and catheters.

Healthcare Market Trends and Demographics Local and International Competition

Israel is a sophisticated and mature market. foreign suppliers face intense competition and should therefore be ready to compete and support their local distributors through educational presentations, material and lobbying/advocacy. Major multinationals and large companies have established direct sales and marketing offices in Israel. Other exporters operate through local distributors.

Digital Health

Israel’s starting point in the digital world is especially good. There is a well-developed infrastructure and high-tech industry that offers innovative tools and applications. The Ministry of Health and Digital Israel are leading a national program that aims to harness and leverage the opportunity inherent in the digital revolution and progress of information and communication technologies. The system connects caregivers and allows them to watch the diagnoses and treatments performed by other practitioners in different organizations. The program also includes the deployment of an ER queues management application that notifies the progress of a patient’s treatment along all patient journey.

Increasing Private Health Spending

The proportion of private financing in national health spending in Israel, on top of the health tax, continues to rise. According to the Israel Central Bureau of Statistics, the proportion of private spending is 40%, making it one of the highest rates in the Organization for Economic Cooperation and Development (OECD), in which the aggregate rate of private health spending is only 28%. The trend is clear and consistent, resulting from an erosion of the public healthcare system’s resources. Private spending is composed of payments for dentistry (most dentistry in Israel is not included in the state health basket), supplementary and commercial health insurance, private care, purchases of medications, deductible payments and purchases of medical equipment.

The rate of public spending has not changed since 1995. The government refrains from increasing the health system’s financial resources, despite population growth and technological requirements. Among other things, every purchase of an MRI machine, or a machine used in cancer radiology treatments, requires a special license. The rationale for this policy on diagnostic imaging devices like an MRI may very well be understandable, since increasing the supply can increase the demand, including unnecessary diagnoses.

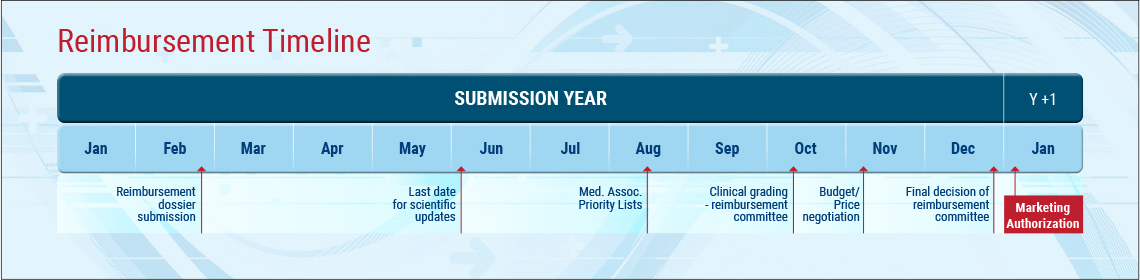

The Reimbursement (National Health Basket) updating process in general

- Call for proposals

- Data collection

- Clinical assessment

- Prioritizing

- Committee final decision

- Government

- Approval and legislation (usually by Dec 31st )

- Marketing authorization valid as of Jan 1st

Committee Structure and Process

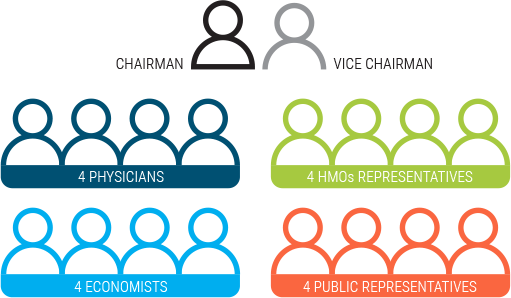

The National Health Reimbursement Committee usually includes 18 members:

- 1 chairman

- 2 representatives of MoH

- 2-3 economists

- 4 clinicians

- 4 representatives of the 4 HMOs (payers)

- 4 public representatives

Once the committee is nominated, it is forbidden by law to have any contacts with committee members.

There are no negotiations with the committee, therefore all negotiations are to be completed before committee’s nomination.

The process of the committee is a process of elimination, i.e. they are not selecting the “best” HTs but are eliminating the less good.

There is a clear rule of dealing with cost of technology and not with cost of disease (i.e. there is not point in showing that a specific HT reduces cost of treatment, saving hospitalization, cost or exams).

Clinicians & KOLs Role

By July, during the year of submission, MoH issues a call to all relevant Medical Associations to submit their lists of priority, i.e. out of the list of relevant HTs submitted that year – what is Medical Association’s priority.

Therefore, it is crucial to know the process of prioritizing of each Medical Association (different associations have different processes) and a clear list of KOL’s mapping.

Data Type

In addition to clinical studies data, the committee looks at Int’l Clinical Guidelines, reimbursement with other reference countries, quality of life data and there is a clear preference for local experience.

Therefore, it is highly recommended to conduct local compassionated use/early experience/NPP programs. There are clear regulations in Israel, as to how to conduct such programs.

Financial evaluation

By completion of the priority stage of HTs, there is a Financial Sub-Committee assessing the Budget Impact (BI) of each HT. BI is calculated according to number of eligible patients, cost of treatment and number of cycles (when relevant).

Price of HTs is to be submitted on a special form, no later than October.

Pricing of HTs in Israel

The maximum price in Israel is determined according to a fixed formula:

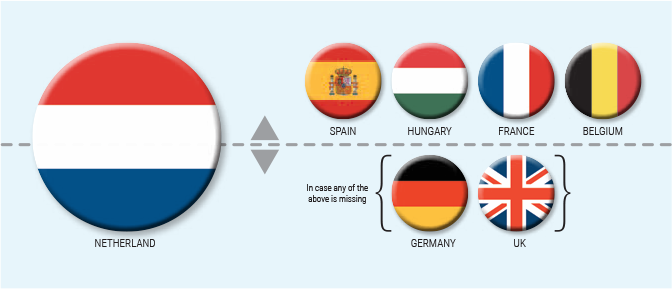

the lowest price between (1) Netherlands and (2) average price of Spain, Hungary, France and Belgium.

In case any of the above is missing, the price is calculated according to the average price between Germany and UK.

Discounts and Risk Sharing Programs

The committee is very fond with risk sharing programs and these can be in the form of:

- Capping – no. of patients or number of doses

- P4P – pay for performance

- Negative Capping – offer first X no. of patients for free

As HTs’ final selection is usually completed by end of December, one should carefully prepare financial proposals in advance, as towards end December most int’l companies are on holiday and there have been many examples when discounts requested or risk sharing programs could not be approved on time.

© 2022 ALL RIGHTS RESREVED

Copyright by BWeinreb Medical Market Access Consulting